Malaysia Sales Tax 2018. Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger.

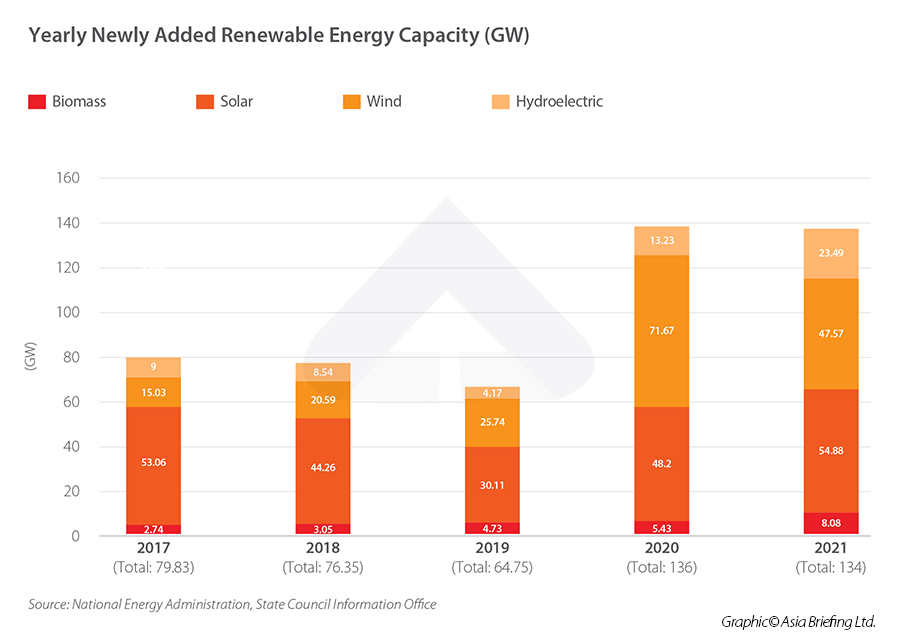

China S Energy Transition How Far Has The Country Come

On the First 5000 Next 15000.

. Malaysia for Malaysian citizen hisher spouse who. The Global Investment Competitiveness Report 20172018 launched today at an international investment forum combines a survey of 750 multinational investors and corporate executives with detailed analysis and recommendations concerning FDI in developing countries. As of tax year 2019 this incentive has been extended to include holders of a bachelors degree as well.

SST Treatment in Designated Area and Special Area. Malaysia Service Tax 2018. Whats more they offer the cheapest deal in town while you can have the professional company formation services.

The tax rate increase as your income increases and the tax rate is based on their chargeable income. Electric Vehicles Solar and Energy Storage. Malaysia Sales Tax 2018.

It also has trade agreements with Bangladesh China India Israel Korea Republic of Laos Malaysia Pakistan the Philippines Sri Lanka Thailand and Vietnam. In Malaysia tax residents are taxed based on a progressive tax rate ie. 2 Order 2019 was only for a period of one year from 1 January 2018 to 31.

Malaysia Setup Company is not merely a team of accounting professionals but who understands the full company formation procedures. On the First 5000. Local and Utility Incentives.

Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. For the employees personal tax liability the Belgian Tax Revenue considers that the payroll WHT amount was entirely withheld.

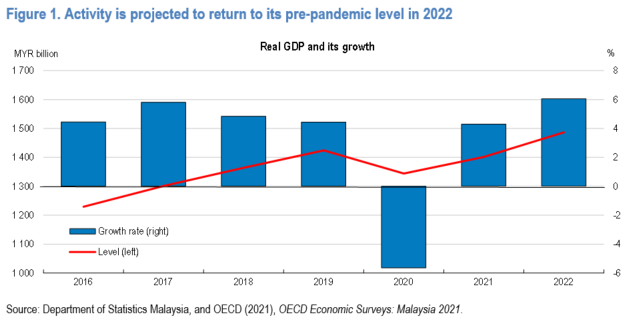

The World Bank estimates that the countrys gross domestic product GDP will expand by 67 in 2018 followed by an annual growth rate of 69 for the next two years. Malaysia Service Tax 2018. You may read on to find more about the foreign-sourced income corporate income tax rate tax incentives and taxation for investment property in Malaysia so that you are well-informed of Malaysias taxation.

Malaysia offers a wide range of tax incentives for the promotion of investments in selected industry sectors which include the traditional manufacturing and agricultural sectors as well as. The exemption is applicable up to 40 of this payroll WHT as of 1 January 2018 and up to 80 as of 1 January. SST Treatment in Designated Area and Special Area.

What are the available 2021 tax incentives for landlords with rental properties. Calculations RM Rate TaxRM A. Incentive claims may be withdrawn and subject to penalty if it is found that incentives are claimed by taxpayers who are not eligible to make such claims.

Income Tax Act 1967 and Government gazette to determine their eligibility prior to claiming any incentive listed in this Appendix.

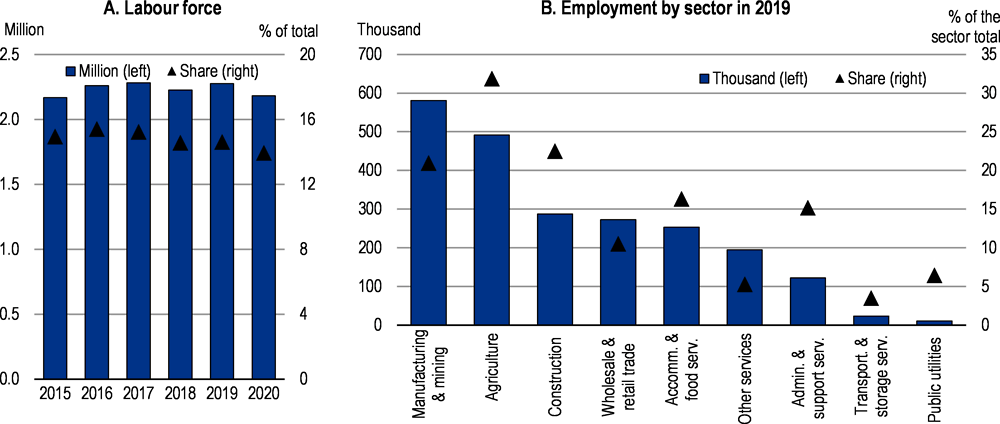

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Tax Incentives In Cambodia In Imf Working Papers Volume 2018 Issue 071 2018

A Land Of Opportunities Mida Malaysian Investment Development Authority

Malaysia S 2018 Budget Salient Features Asean Business News

Malaysia 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Malaysia In Imf Staff Country Reports Volume 2022 Issue 126 2022

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

Malaysia 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Malaysia In Imf Staff Country Reports Volume 2022 Issue 126 2022

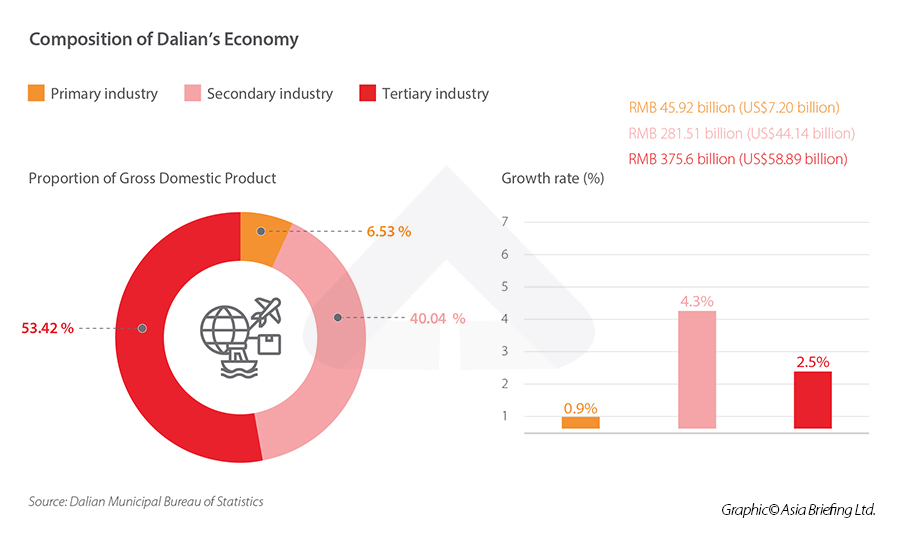

Investing In Dalian Key Industries And Preferential Zones To Set Up

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

Tax Incentives In Cambodia In Imf Working Papers Volume 2018 Issue 071 2018

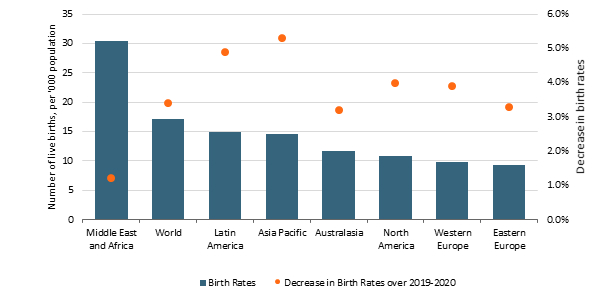

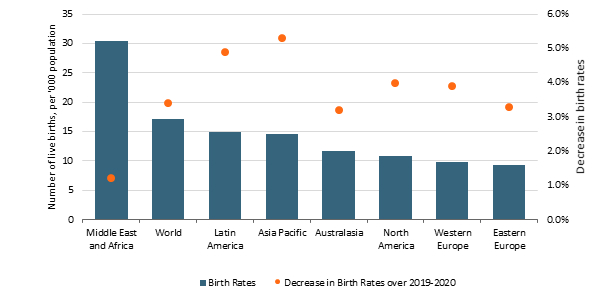

Boom Or Bust Birth Rates During The Pandemic Euromonitor Com

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

Tax Incentives In Cambodia In Imf Working Papers Volume 2018 Issue 071 2018

Brazil Economic Policy Reforms 2021 Going For Growth Shaping A Vibrant Recovery Oecd Ilibrary